tax sheltered annuity limits 2021

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Diversity Equity.

403 B Tax Sheltered Annuity Plans Renton School District 403

It is also known as a 403 b retirement plan and.

. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. A tax-sheltered annuity plan gives employees. For the tax year 2021 the IRS will limit contributions to TSAs to 19500.

We will mail checks to qualified applicants as. Pension and Annuity Exclusion New York State city of New York and city of Yonkers resident individuals estates. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations.

The IRS recently announced the 2021 contribution limits for the UW Tax-Sheltered Annuity TSA 403 b Program and the Wisconsin Deferred Compensation WDC 457 Program. The university offers two types of plans under the 403b or Tax-Sheltered Annuity Plan a pre-tax plan and an after-tax or Roth option. If youre 50 or older you can.

What is a Tax-Sheltered Annuity. The Internal Revenue Service IRS announced yesterday October 26 2020 the following dollar limits applicable to tax-qualified plans for 2021. Available on the Tax Departments web site at wwwtaxstatenyus.

The IRS reviews returns on. 7Changes in real estate values or. 6Withdrawals of taxable amounts from an annuity are subject to ordinary income tax and if taken before age 59½ may be subject to a 10 IRS penalty.

This combination of codes usually results when you claim earned income credit often in combination with the additional child tax credit on your return. The maximum amount you can contribute to a 403 b plan from your salary for 2022 is 20500 up from 19500 in 2021. Since a composite return is a combination of various individuals various rates cannot be assessed.

But this will increase to 20500 in 2022 matching the. The limit on the maximum. Therefore the composite return Form NJ-1080C uses the highest tax.

Contributions are taken from employees paychecks. For State Employees Civil Service Board.

Retirement Plan Maximum Contributions And Tax Deductions

:max_bytes(150000):strip_icc()/GettyImages-691573537-e0ad139ceab54c78a53e922204b34899.jpg)

403 B Plan Contribution Limits For 2021 And 2022

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

403 B Contribution Limits For 2021 Kiplinger

Learn About Retirement Income And Annuity Tax H R Block

457 Plan Vs 403 B Plan What S The Difference

Publication 560 2021 Retirement Plans For Small Business Internal Revenue Service

Sec 457 Government Plan Distributions Compared To 401 K Distributions

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

The Benefits Of A 403 B Retirement Plan Sdg Accountants

Withdrawing Money From An Annuity How To Avoid Penalties

/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)

457 Plan Vs 403 B Plan What S The Difference

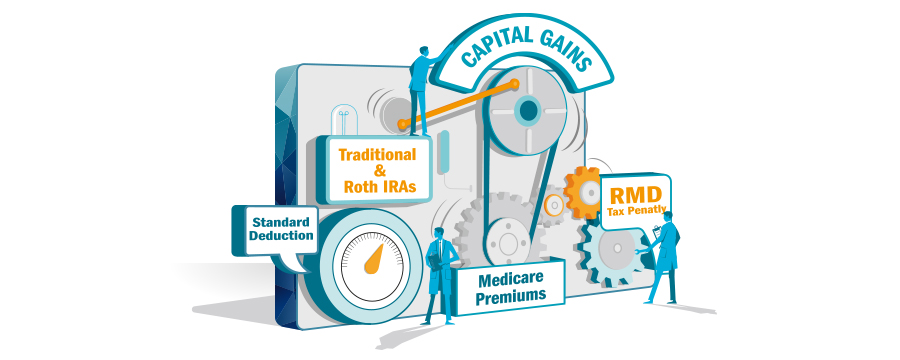

Tax Planning For Retirement Ameriprise Financial

What Is A 403b Tax Shelter Annuity And How Does It Work